Are You Making One of the 7 Costly Crypto Tax Mistakes That Could Trigger an IRS Audit?

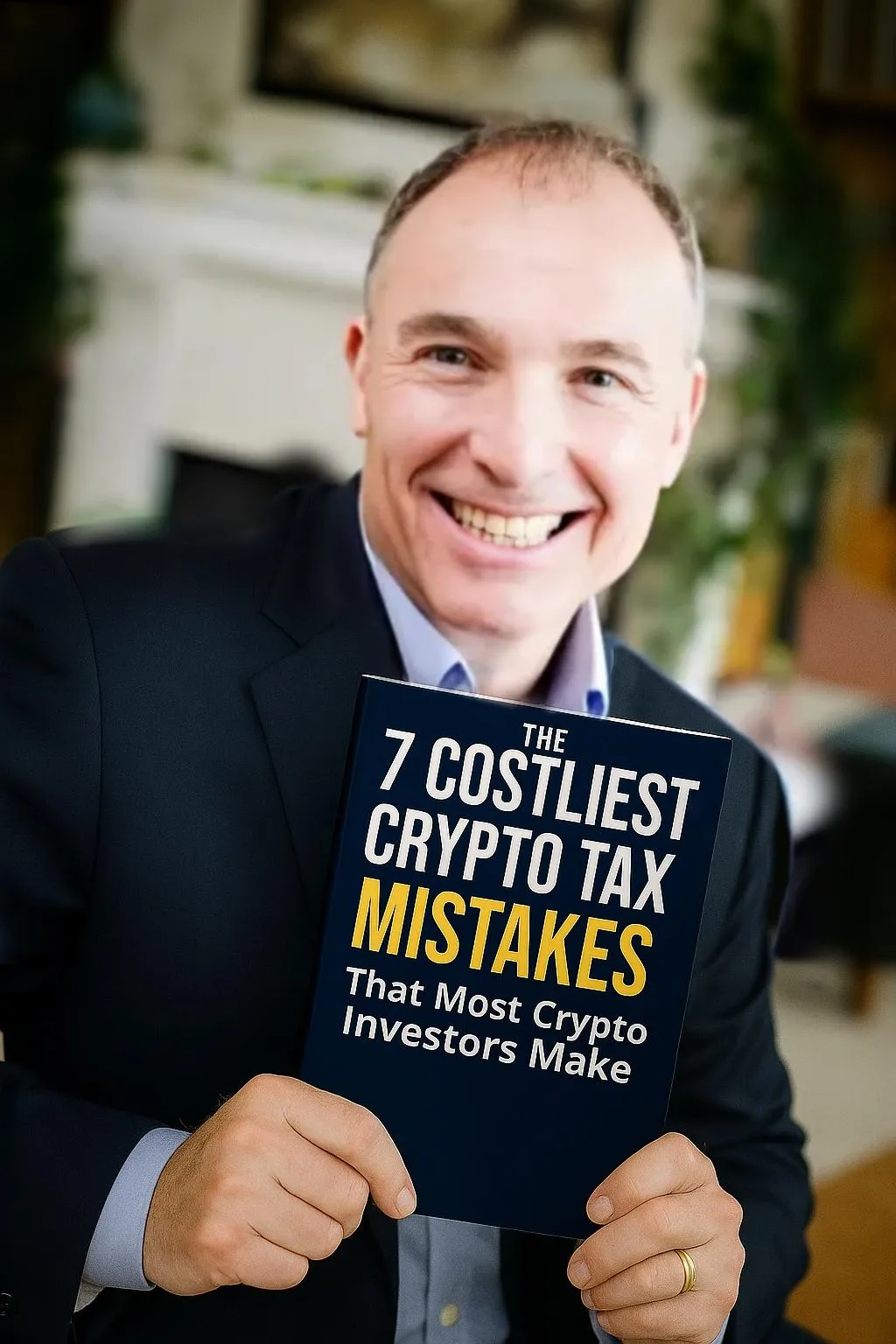

A FREE Complete Guide by Rafael Stuchiner, Retired NYC Tax Lawyer

(Used by 2,300+ crypto investors to fix past filings and reduce tax bills legally)

The IRS is now receiving direct transaction data from Coinbase, Kraken, Binance.US, and others — and they’re targeting investors who didn’t report correctly.

Even if you never cashed out, staking rewards, DeFi yields, NFT trades, and airdrops are taxable events — and 93% of filers miss them.

In this 11-page guide, you’ll discover:

THE #1 MISTAKE

Treating Crypto-to-Crypto Trades as "Non-Taxable Exchanges

Why this is CATASTROPHICALLY WRONG

The REAL COST

How to IDENTIFY if you've made the MISTAKE

How to FIX IT

Secure, instant access. No cost. No risk.

This guide has helped over 2,300 investors avoid audits and fix their crypto taxes — and it’s 100% free.

If you don’t find at least one actionable fix to save money or reduce risk, email us — and we’ll send you a referral to a top crypto tax pro. No charge.

The IRS has labeled crypto as a “high-risk non-compliance area.” Tax season is coming — and so are the audits.

Don’t wait until you get a letter. Fix it now — while it’s still free.

by Rafael Stuchiner

Retired NYC Tax Lawyer & Entrepreneur

Crypto Tax Authority © 2025. www.Cryptotaxauthority.com Questions? [email protected] | Terms & Conditions